The Art of Negotiation in Communication: Mastering Insurance Claims with Storms Anchor Insurance

Introduction: Negotiating Is Everywhere—Especially in Insurance Claims

When disaster strikes, negotiation becomes more than a business tactic—it’s a lifeline. For independent insurance agents and claimants facing a recent loss, the path to a fair settlement is not just about paperwork or numbers; it’s fundamentally about human communication, strategic advocacy, and knowing your rights. Every insurance claim opens a negotiation, whether you recognize it or not. At Storms Anchor Insurance, our negotiation strategies are designed to empower you in conversations with your insurer. Our tips can help you present your case more clearly and confidently. We provide educational resources to help you navigate the claims process. We do not provide legal advice or make coverage determinations.

Negotiation is not confined to boardrooms or hostage crises. It lives in every call with an adjuster, every piece of supporting evidence you gather, and each conversation about what fair compensation looks like after a loss. Drawing on negotiation classics like Chris Voss’s Never Split the Difference and Roger Fisher and William Ury’s Getting to Yes, this piece explores both the principles and actionable steps to transform you—from an uncertain claimant to a confident negotiator with your insurance company.

Understanding Insurance Claims Negotiation: Why Every Claim Is Negotiable

Insurance claims negotiation is at the heart of the policyholder–insurer relationship. When you file a claim—be it for property damage, business interruption, or personal injury—you open a dialogue. This isn’t just about exchanging documents; rather, it is a negotiation with your insurance company regarding the interpretation of your policy, the amount of compensation, and the terms of settlement.

For agents and insureds alike:

Insurers are sustainable when they minimize payouts; claimants maximize their recovery when they advocate effectively.

Most initial offers are lower than what your coverage truly allows.

Negotiation skills can mean the difference between an unsatisfactory payout and the resources needed to truly recover.

Claims negotiation is not a confrontation. It’s a collaborative, yet strategic, communication process—one that is both an art and a science.

The Foundations: Principles of Negotiation

Fisher and Ury’s four principles from Getting to Yes provide a bedrock for any negotiation, especially insurance claims:

1. Separate the people from the problem:

Treat the insurance adjuster as a partner in solving the problem, not the problem itself. By focusing on the facts and policy terms, not personalities, you preserve professional relationships—especially vital in ongoing agent-client or insurer-insured relationships.

2. Focus on interests, not positions:

For claims, don’t just argue for “the biggest check.” Demonstrate your need based on documented repairs, actual medical costs, future financial impact, and policy protections.

3. Invent options for mutual gain:

Brainstorm with your adjuster. Is there an alternative settlement structure? Additional living expense coverage? Ways to expedite payment? Sometimes, creative solutions expand value for both sides.

4. Insist on using objective criteria:

Anchor negotiations in your policy’s limits, market repair estimates, legal precedent, and objective documentation—rather than opinions or pressure tactics.

Applying these time-tested principles transforms a back-and-forth battle into a results-driven collaboration.

Never Split the Difference: Tactical Empathy and Insurance Claims

Chris Voss redefined negotiation by demonstrating that emotional intelligence, not just rational argument, is what gets results—even with hostage-takers, let alone insurance adjusters. His techniques map perfectly onto insurance negotiations:

Tactical Empathy

Tactical empathy is central. Acknowledge the adjuster’s pressures: they are tasked to manage risk and payouts—but they are also people with constraints and professional standards. By articulating the challenges and validating their position, you lower defensiveness and make collaboration possible.

“It looks like you’re concerned about following your company’s guidelines.”

“You seem to be under pressure to justify every dollar paid out. Let’s see if we can make this easier using the documents I’ve provided.”

Active Listening and Mirroring

Active listening—paraphrasing or “mirroring” what the adjuster says—can prompt them to reveal more about their calculations, doubts, or room for movement.

Example: They say, “Unfortunately, our estimate is based on average repair costs in your region.”

You reply, “Average repair costs in this region?” This invites elaboration and may uncover flexibility.

Labeling Emotions

Address unseen emotions directly:

“You sound frustrated with how complex this claim is becoming.”

“You’re being cautious because you’ve had claims where documentation was missing.”

This labeling diffuses tension and invites the adjuster to open up, making the process less adversarial.

Creating the Illusion of Control and Calibrated Questions

Ask calibrated questions (typically starting with “What” or “How?”). This gives your counterpart a sense of agency, prompting collaboration towards a solution:

“How can we reconcile this estimate with the market prices in my area?”

“What would it take for you to feel comfortable recommending the higher payout to your supervisor?”

Avoid “why” questions that can sound accusatory and trigger resistance.

The Power of 'No'

Encourage a “no” response to make the adjuster feel safe and in control, which often leads to meaningful dialogue:

“Would it be out of the question to review a second contractor’s estimate?”

Framing the question this way means that a “no” doesn’t shut down the conversation—it advances it.

Voss’s approach recognizes that claims negotiation is fundamentally human, driven by trust, rapport, and careful advocacy.

Building Your Negotiation Toolkit: Keys to Negotiating Insurance Claims

1. Start with Policy Mastery

You can’t negotiate what you don’t understand. Begin by carefully reviewing your policy:

Coverage types, limits, and deductibles

Named perils or covered causes of loss

Exclusions and special sub-limits

Endorsements and riders for additional protection

A well-prepared policyholder enters negotiation already armed with knowledge, turning the first conversation into an opportunity to “anchor” expectations in fact, not opinion.

2. Documentation Is Negotiation Power

Documentation is the language of insurance claims—and the foundation of your negotiating leverage:

Photographs and video of all damages, including before and after loss comparisons

Estimates from licensed contractors, not just insurance company representatives

Receipts and invoices for repairs, temporary housing, and related expenses

Medical records (for injury claims), lost income documentation, and any relevant correspondence

Logs of phone calls, emails, and in-person conversations with adjusters

Complete documentation shrinks the adjuster’s room to “lowball” your claim and strengthens your negotiating posture.

3. Calculate and Justify a Realistic Settlement Demand

Be ready to justify the full value of your claim:

Total all documented expenses plus reasonable future costs.

Research average settlement values for similar claims in your area.

Include “soft” costs such as additional living expenses, pain and suffering, or business interruption—if your policy covers them.

Present these calculations with evidence, so your ask is reasonable and difficult to dismiss.

Tactical Moves: How to Negotiate Your Insurance Claim Effectively with Your Insurance Company

Communicate Professionally—but Assertively

Emotions can run high after a loss, but negotiation works best when you remain calm, fact-driven, and clear:

Always put important points in writing—this creates an audit trail and prevents misunderstandings.

Thank adjusters for their responsiveness, but assert your position.

Avoid ultimatums, threats, or emotional arguments, which can backfire or delay settlements.

Don’t Accept the First Offer

Virtually all experts agree: The first offer is almost never the insurer’s best. It may be a lowball bid to “anchor” the discussion or test your resolve. Instead of accepting:

Thank the adjuster and request a full explanation on how they calculated the offer.

Identify any inaccuracies, missing items, or unexplained reductions.

Provide counter-documentation and a polite but firm counteroffer, demonstrating your knowledge and that you expect fair treatment.

Handle Delay and Deflection Tactics

Insurance companies may delay, request redundant documents, or say “management has to review” as pressure tactics. Don’t become discouraged:

Schedule regular follow-ups.

Politely escalate concerns to supervisors or state insurance regulators if the process stalls unreasonably.

Use Anchoring Wisely

If the adjuster tries to anchor negotiations with a low first offer, counter-anchor with your own well-supported demand, explicitly tied to evidence—not just emotion.

When possible, make the first credible, evidence-backed offer, setting the frame for what is “reasonable” in the negotiation.

Calibrated Questions: The Adjuster’s Dilemma

Use questions that require the adjuster to be a problem-solver alongside you:

“What policy language are you referencing for that reduction?”

“How did you arrive at the depreciation on these items?”

“What information would you need to justify my loss figure to your management?”

Such questions shift some of the cognitive and emotional burden to the adjuster—a proven method to move negotiations forward.

Get It in Writing

When agreement is reached, demand a written, detailed settlement offer specifying what is covered, which damages are included, and when payment will be made. This avoids future disputes and gives you recourse if the carrier backtracks.

Rapport with Adjusters: Navigating Human Dynamics

While fact-based advocacy is essential, building rapport with your adjuster—seeing them as a human being rather than an adversary—can be equally critical for positive outcomes.

Be courteous but persistent.

Acknowledge their workload and pressures.

If disagreements become heated, pause and reset—personal attacks or antagonistic posturing rarely help.

Rapport doesn’t mean rolling over; it means humanizing the exchange to maximize cooperation.

Knowing Your Legal Rights and the Good Faith Duty

Insurance companies are legally required to handle claims in good faith under state law. Insurance companies have made a promise to bring you back to how you were before the incident. This means:

Investigating claims promptly and fairly.

Explaining denials or reductions with clarity.

Paying valid claims without unreasonable delay.

Not using intimidation, misrepresentation, or “bad faith” tactics to force lower settlements.

If you suspect your claim is being handled in bad faith (for instance, denied without proper investigation or lowballed with no rationale), you can:

Appeal internally within the company.

File a complaint with your state insurance regulator.

Consult a qualified attorney for possible litigation, especially if large sums are at stake.

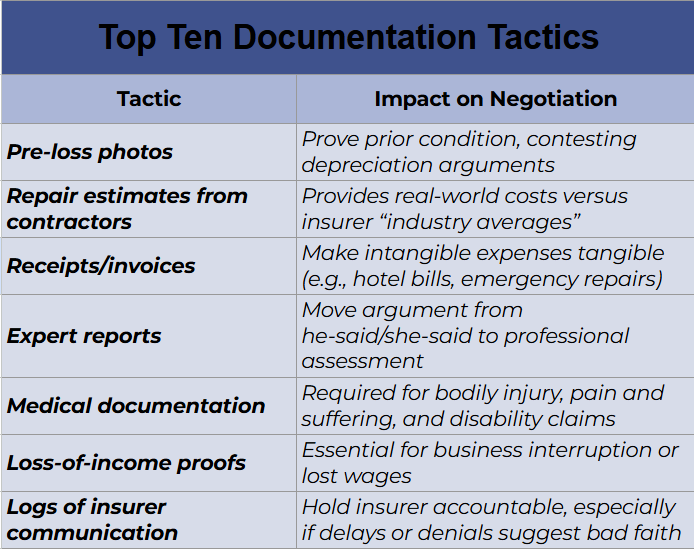

Documentation and Evidence: The Currency of Insurance Negotiation Explanation:

Insurance Claims Negotiation Documentation Tactic Chart | StormsAnchor.com

A claims negotiation is only as strong as the evidence presented. This table demonstrates that comprehensive records constrain the insurer’s ability to reduce, delay, or deny your claim. For larger or complex claims, professional help— such as hiring a public adjuster or expert appraiser— can pay for itself by strengthening your negotiating leverage.

When to Seek Professional Help

Not all insurance negotiations are made equal. Sometimes, you’ll face a complex, high-value, or contentious claim. In those cases:

Public Adjusters: Skilled advocates representing policyholders, not insurers. They know the tactics, documentation standards, and how to maximize settlements. Often paid on contingency, public adjusters are a good option for difficult or underpaid large property claims.

Attorneys: If bad faith, denial, or legal disputes arise, consult a qualified insurance attorney for guidance on rights, appeals, and legal remedies.

Don’t hesitate to “level the playing field”—the insurance company has professionals; you deserve advocates as well.

Case Studies: Learning from Successful Insurance Claims Negotiations

Case 1: Overturning a Denied Multi-Million Dollar Commercial Claim

A commercial policyholder faced denial for a hailstorm damage claim to a 700,000 sq ft structure. Critical steps that resulted in reversal included:

Gathering detailed occurrence data, expert reports, and photographic evidence.

Presenting a comprehensive, organized claim package that left little room for denial.

Leveraging statutory requirements to hold the insurer to its contractual obligations.

The result: Litigation was avoided, and the policyholder received a multi-million-dollar settlement, proving the value of preparation, documentation, and strategic negotiation.

Case 2: Residential Policyholder’s 30% Higher Payout

A homeowner faced a lowball offer after storm damage. By securing independent expert opinions, providing detailed repair estimates, and persistently re-engaging the adjuster, the claimant secured a settlement more than 30% above the initial offer. The lesson: Never take the first offer—counter, justify, and persist.

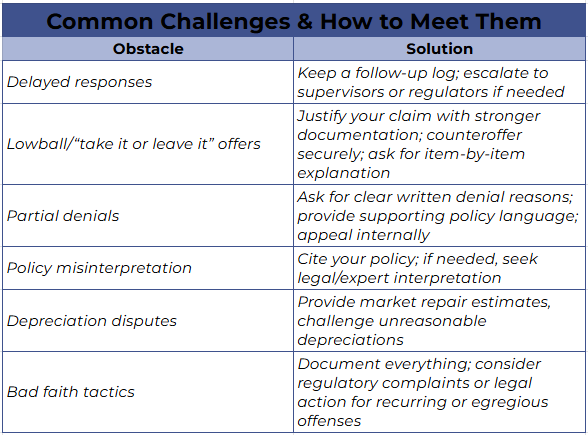

Overcoming Obstacles: Navigating Delays, Denials, and Underpayments

Overcoming Delays in Insurance Claims Negotiation | StormsAnchor.com

Insist on transparency, documentation, and your legal rights every step of the way.

Keys to Claims Negotiating with Insurance Companies: Storms Anchor Insurance Takeaways

You can negotiate anything in your insurance claim: Every offer, every denial, and every policy interpretation can—and should—be checked against policy obligations, documentation, and legal requirements.

Master your policy, document everything: Being organized, informed, and persistent is more powerful than bluster.

Humanize the process: Build rapport, listen carefully, and use tactical empathy to turn insurance adjusters from adversaries to partners.

Use evidence as your anchor: Objective documentation is unassailable, making it the backbone of any successful negotiation.

Don’t accept the first offer: Always seek a detailed explanation for reductions and counter with your own evidence.

Know your rights: Insurers must act in good faith; you always have the right to appeal, complain, or seek professional guidance.

Persist with professionalism: Don’t be afraid to follow up, escalate, and, when necessary, fight for what’s fair.

Seek expert help when stakes are high: Bring in public adjusters or attorneys as needed—don’t go it alone against a well-resourced company.

Conclusion: Claims Negotiation Is Not Just a Right—It’s a Skill You Can Master

Whether you’re an independent agent seeking to best support your clients, or a policyholder negotiating your own recovery, you have more influence—and more rights—than you might think. The core lesson from the negotiation masters is clear: Every insurance claim is a negotiation, every claim negotiation is an opportunity, and every opportunity is won by those who prepare, listen, and advocate with confidence.

At Storms Anchor Insurance, We help you understand your coverage and communicate effectively with your insurer. We guide you through the negotiation process to help you advocate for fair treatment. The art of negotiation isn’t just for boardrooms. It’s for everyone who refuses to let insurance be a one-sided deal.

The content of this article is for educational purposes only.

It does not constitute legal advice or create an attorney-client relationship.

Readers should consult their insurance provider or legal counsel for specific advice.

Disclaimer: This article is intended for informational purposes only and does not constitute legal advice. Storms Anchor Insurance does not assume any duty to defend or reserve rights on behalf of any insurer or policyholder. For specific claims guidance, please consult your insurance provider or legal counsel.

StormsAnchor.com | Copyright © Storms Anchor Insurance 2025

Empowering Agents and Policyholders—One Strong Negotiation at a Time.